The answer to New Era Requirements:

Our Products & Solutions

To compete in this ever-changing digital age, companies must re-invent themselves by adopting state-of-the-art digital solutions that are highly adaptable, effortless, and low-cost.

M^Dynamics-powered solutions provides you a new generation of enterprise payment and financial switching products with digital transformation capability, multi-currency, multilingual and interoperable features that supports multi-channels (terminal, tablets, mobile, browser, REST API etc.).

Apart from the modules that handle OLTP, M^Dynamics also provides a set of reporting tools to support back-office functions with other external parties such as settlement, reconciliations, reporting, Bizops UI/Business support functions, etc.

M^Dynamics helps us efficiently sink all the stakeholders involve in the payment transaction processing flow.

Each product we have can be mixed and matched to create new solutions suited to your needs, or create a fully integrated and seamless omni-channel payment hub.

GUARANTEED COMPLIANCE

BETTER VALUE PROPOSITION

COST EFFECTIVE

EASILY CUSTOMISABLE

MODULAR & REUSABLE COMPONENTS

SIMPLER & DESIGN EFFICIENT

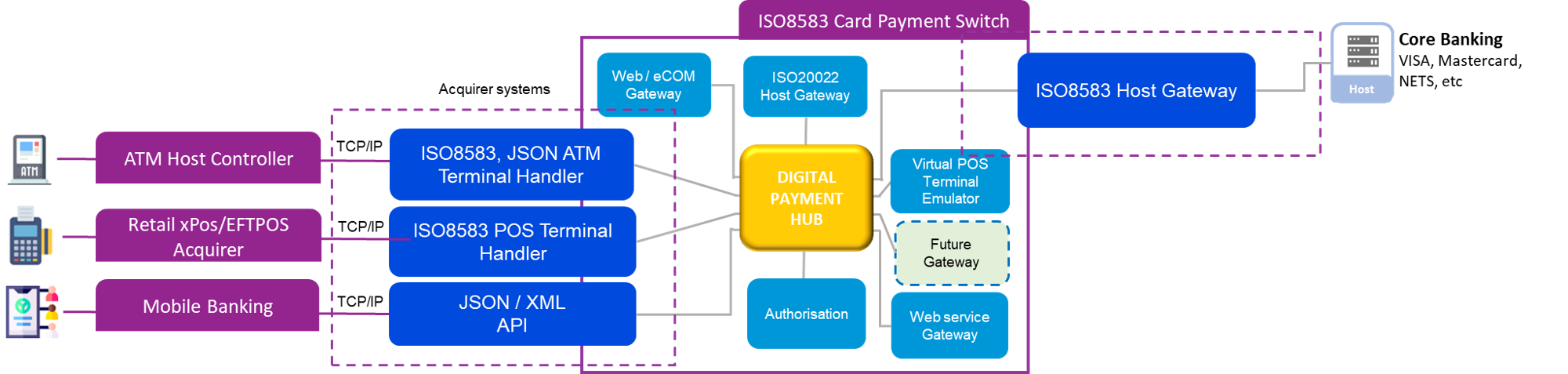

Front-End Acquiring

M^Dynamics can be easily extended to support other devices and host processors that use different message formats by using M^Dynamics Transformation mapper.

M^Dynamics Switch also uses profiles extensively to ease the configuration of a large number of ATM and EFTPOS devices in the network.

Retail xPos/EFTPOS Acquirer

- Inherit all the benefits/features of M^Dynamics –

• Flexibility, High Performance, Massive Scalability, Continuous Availability, Manageability, Integrity etc

- Supports Standard EFTPOS functions

• Admin Functions

- Initialization, Session Key Exchange (support TR31 via HSM), Status

• Customer Transactions

- Purchase, Refund, Adjustments, Purchase with Cashback, Balance Inquiry, PIN Change, Credit & Debit Card Transactions, etc.

- Flexibility to Support non-Standard features/functions

- Security enforced by

• Use of HSM (SafeNet, Thales)

• Dynamic Session Key exchange

• DUKPT via HSM

• MACing of all messages

• Encrypted PIN Block throughout life-cycle (PIN translation in HSM, support Format4 via HSM)

• Support of secured Comm Protocol TLS 1.3, SSL, HTTPS

ATM Host Controller

- Inherit all the benefits/features of M^Dynamics –

• Flexibility, High Performance, Massive Scalability, Continuous Availability, Manageability, Integrity etc.

- Supports Standard ATM functions

• Admin Functions

- Initialization, Session Key Exchange (support TR31 via HSM), Supervisor Maintenance, Status

• Customer Transactions

- Cash Withdrawal, Cash Deposit, Transfer, Balance Inquiry, PIN Change etc.

- Flexibility to Support non-Standard features/functions

• eKYC features for account opening (integrating with multi-host with different formats)

• Multi-currency notes withdrawal, Forex exchange, Bill Payment, purchase tickets etc.

• 3rd Party eWallet Cash Withdrawal, Biometrics support etc.

- Security enforced by

• Use of HSM (SafeNet, Thales)

• Dynamic Session Key exchange

• MACing of all messages

• Encrypted PIN Block throughout life-cycle (PIN translation in HSM, support Format4 via HSM)

• Support of secured Comm Protocol TLS 1.3, SSL, HTTPS

- Message Formats Supported

• Currently support ISO8583, JSON, ISO20022 format

• Limited support for NDC+/DDC message format

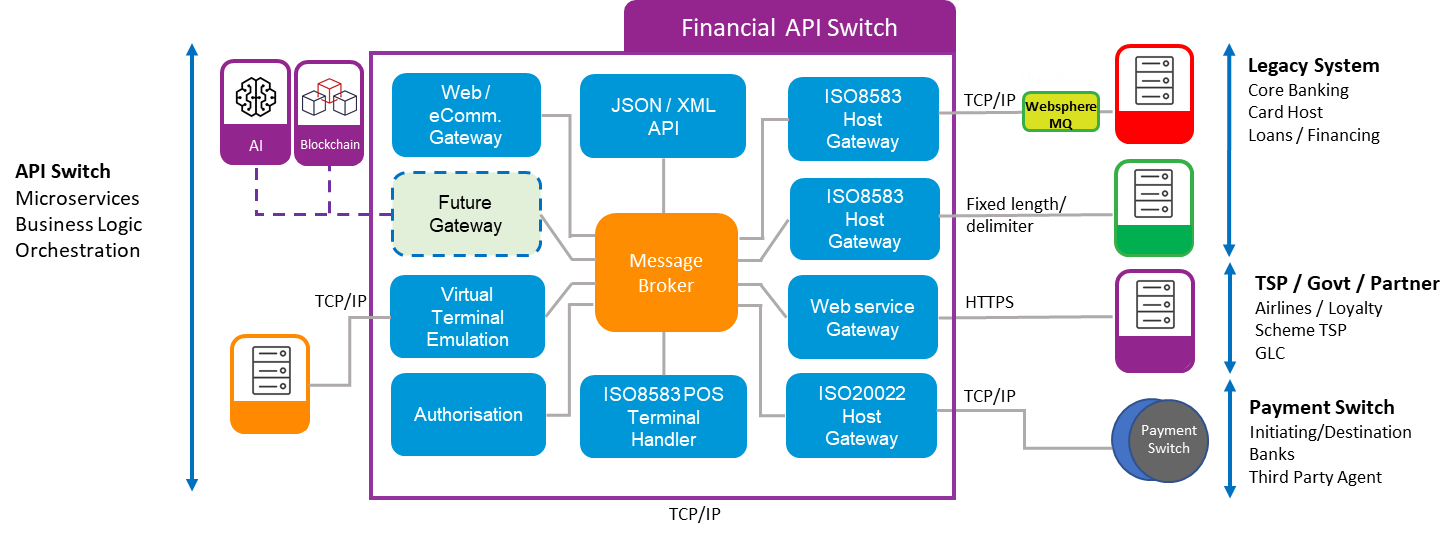

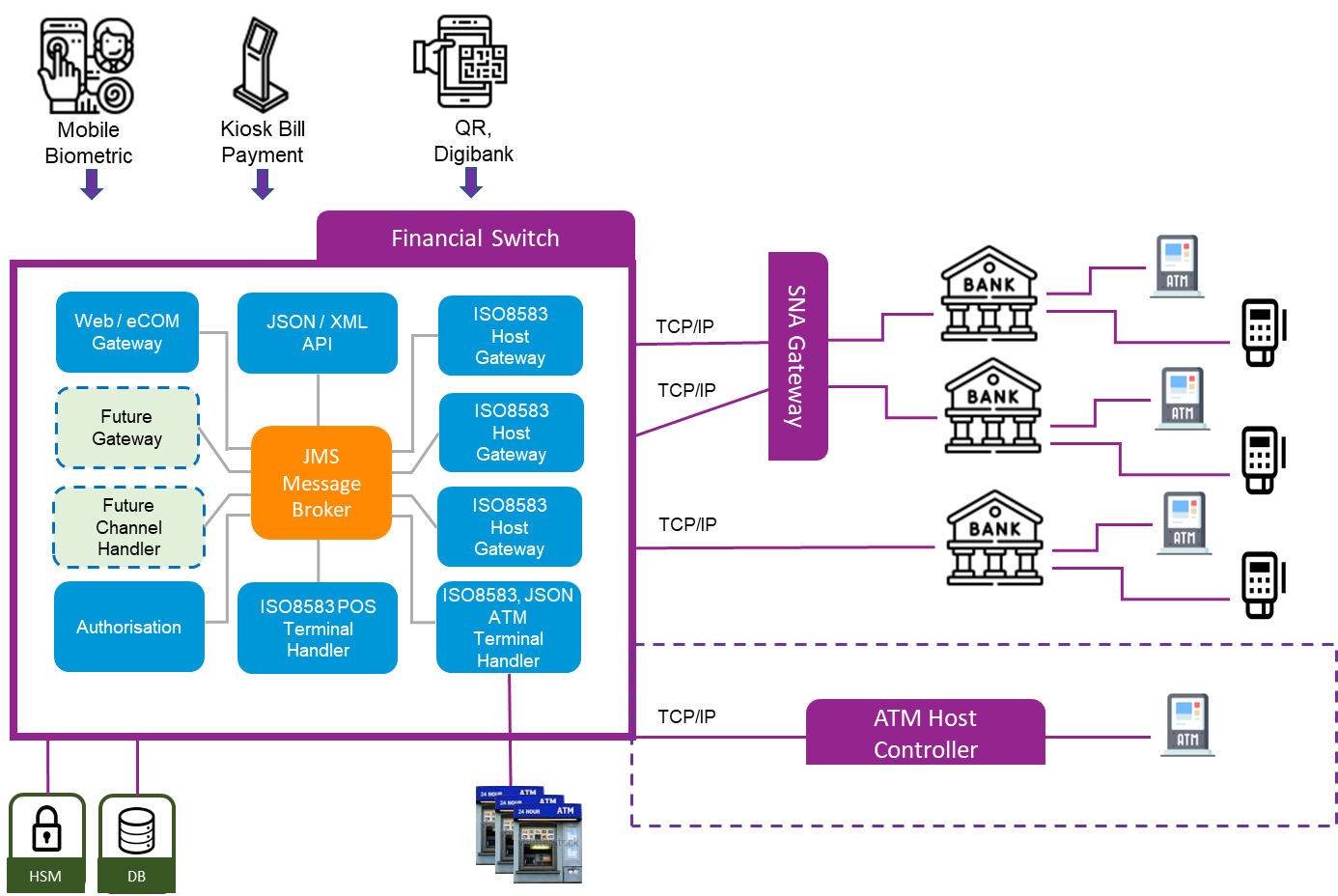

Switch/Gateway & Interfaces

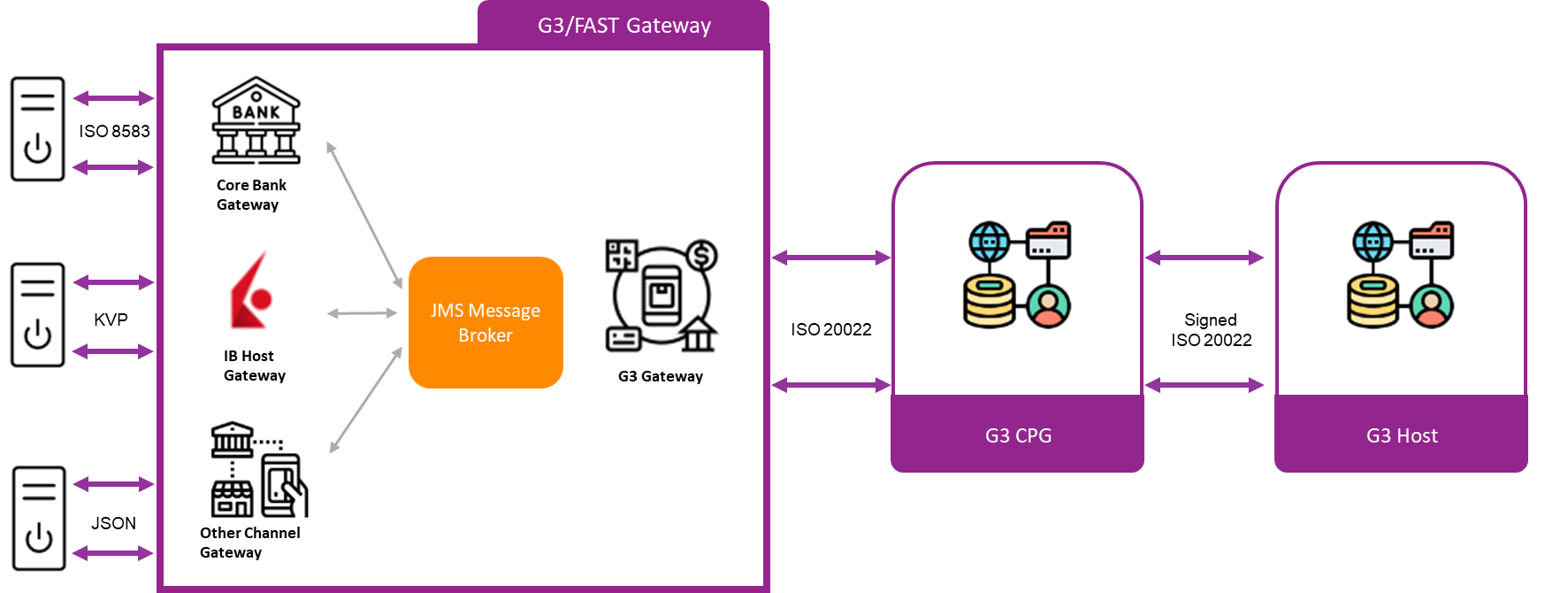

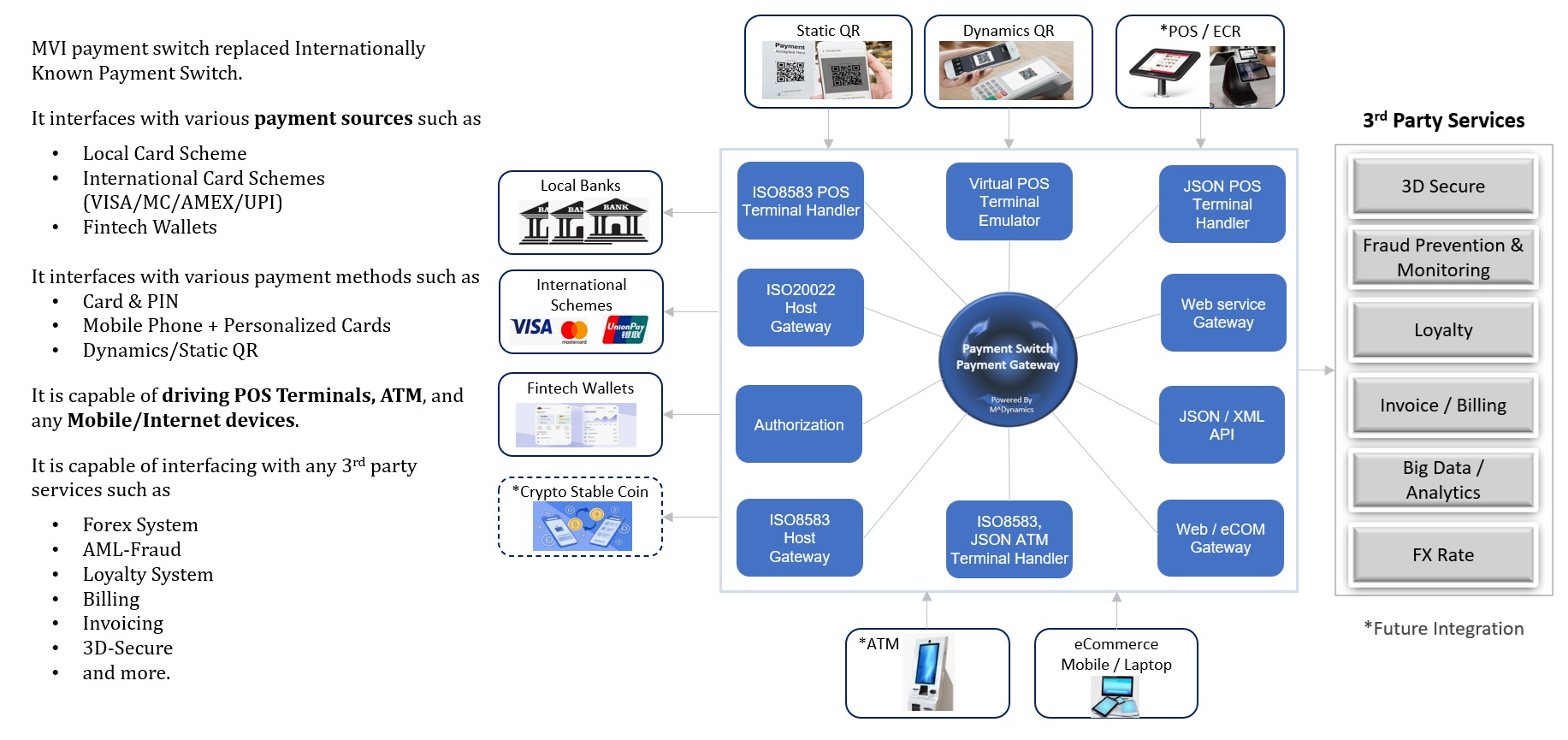

MVI provides many different switch/gateways and interfaces to connect to various internal systems and external parties.

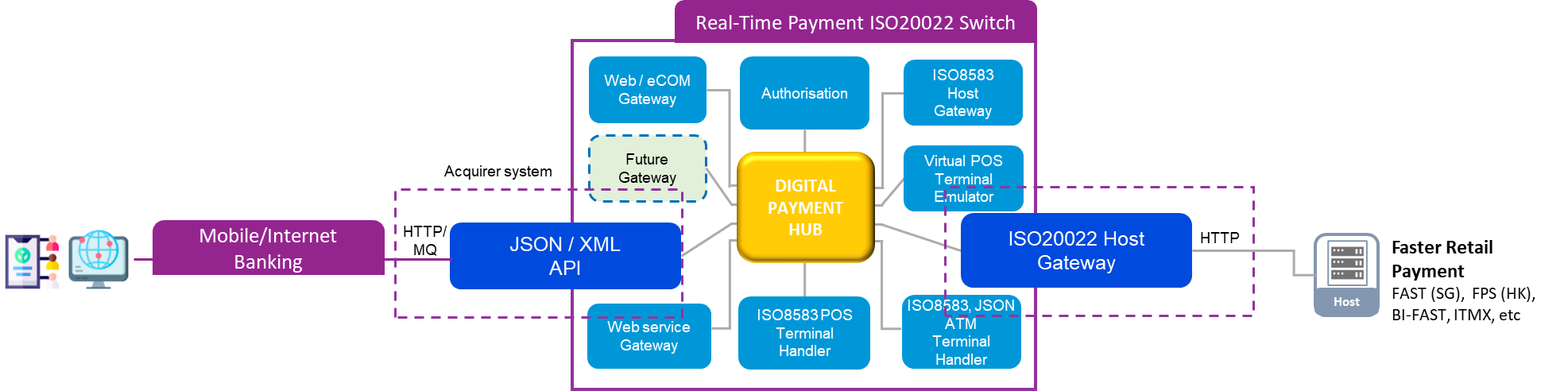

Such as ISO8583 for core banking systems , ISO20022 for mobile/internet banking systems, SWIFT MT/MX to for cross borders systems, and G3/FAST for national payment systems.

Payment Switch / Gateway

Empowering Payment Business using Mission-Critical Payment Switch/Gateway

(Efficient, Reliable, and Secure)

In a world driven by digital transactions, precision and speed are paramount. Introducing MVI's cutting-edge Payment Switch and Gateway Integration. Elevate your payment processing to unparalleled levels of efficiency, security, and customer satisfaction.

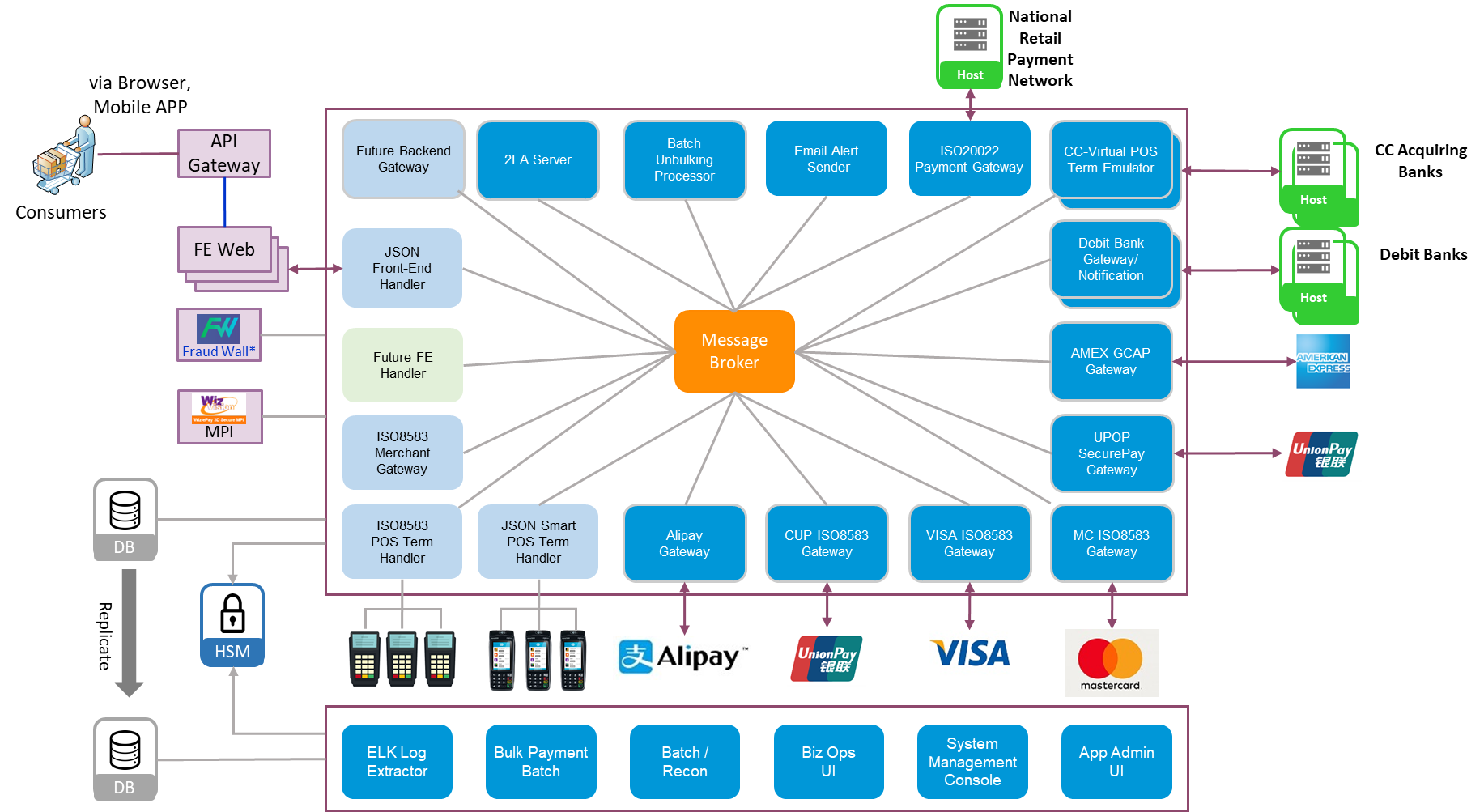

The payment switch / payment gateway is capable of:

- Driving Point-Of-Sales Terminals

- Driving ATMs

- Supporting Merchant Website for electronic commerce.

These results are factual and verifiable as tested on the LinuxONE environment. IBM Z and IBM LinuxONE systems share the same underlying hardware architecture. As a result, the performance of a Java application is expected to be comparable across both platforms, assuming equivalent configurations and workload characteristics.

M^Dynamics Payment Switch & Gateway: Ensure secure and efficient transactions, backed by a track record of success.

M^Dynamics Payment Switch is a system that routes payment transactions between different banks and financial institutions. It acts as a central hub that connects all of the participants in the payment network.

M^Dynamics Payment Gateway is a system that processes online payments. It collects payment information from customers and transmits it to the payment switch for authorisation and processing.

Real-Time Payment ISO20022 Switch

MVI M^Dynamics Payment switch supports and is equipped with ISO20022 for many years, thus giving us the experience and expertise of ISO20022.

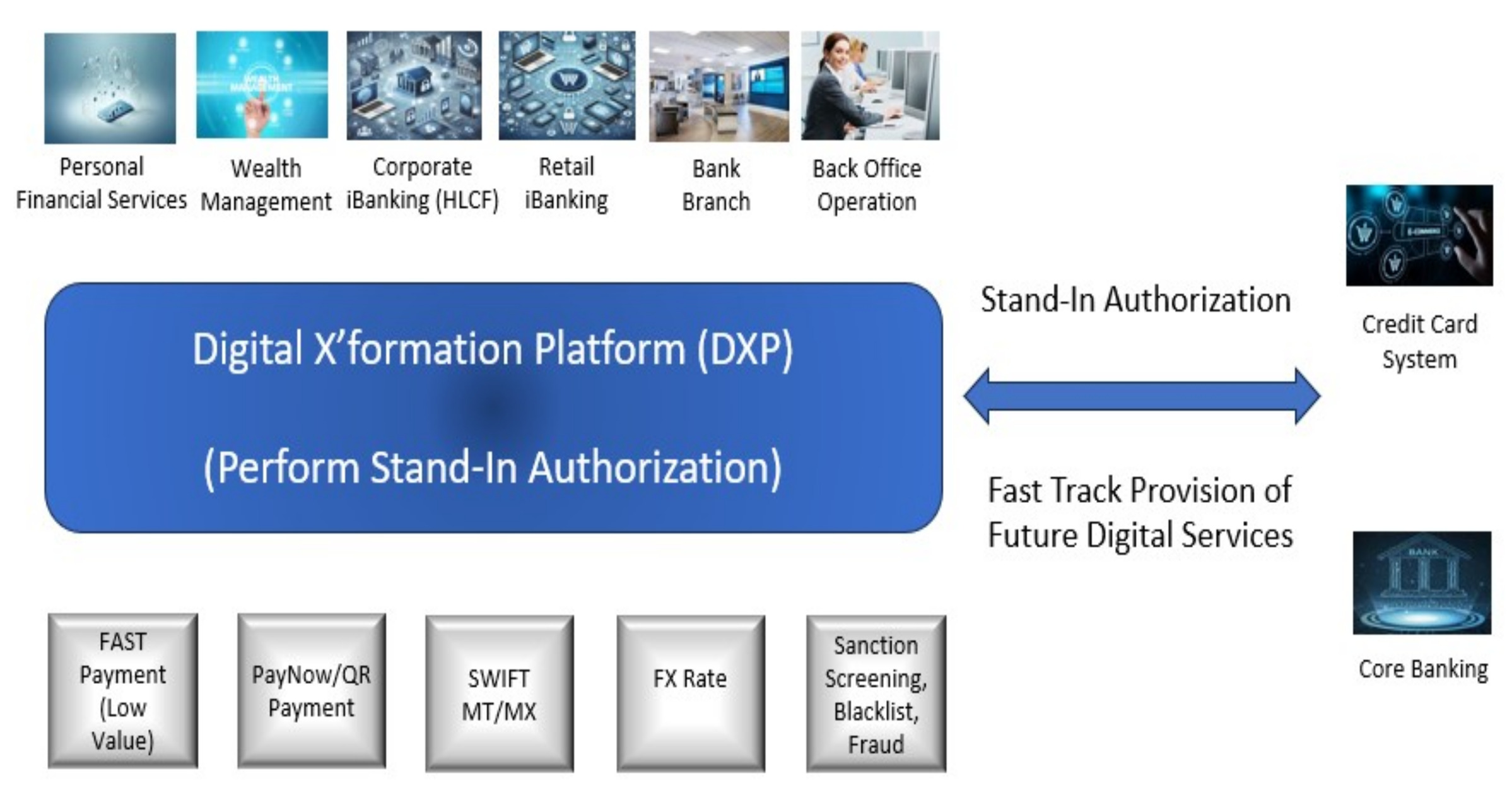

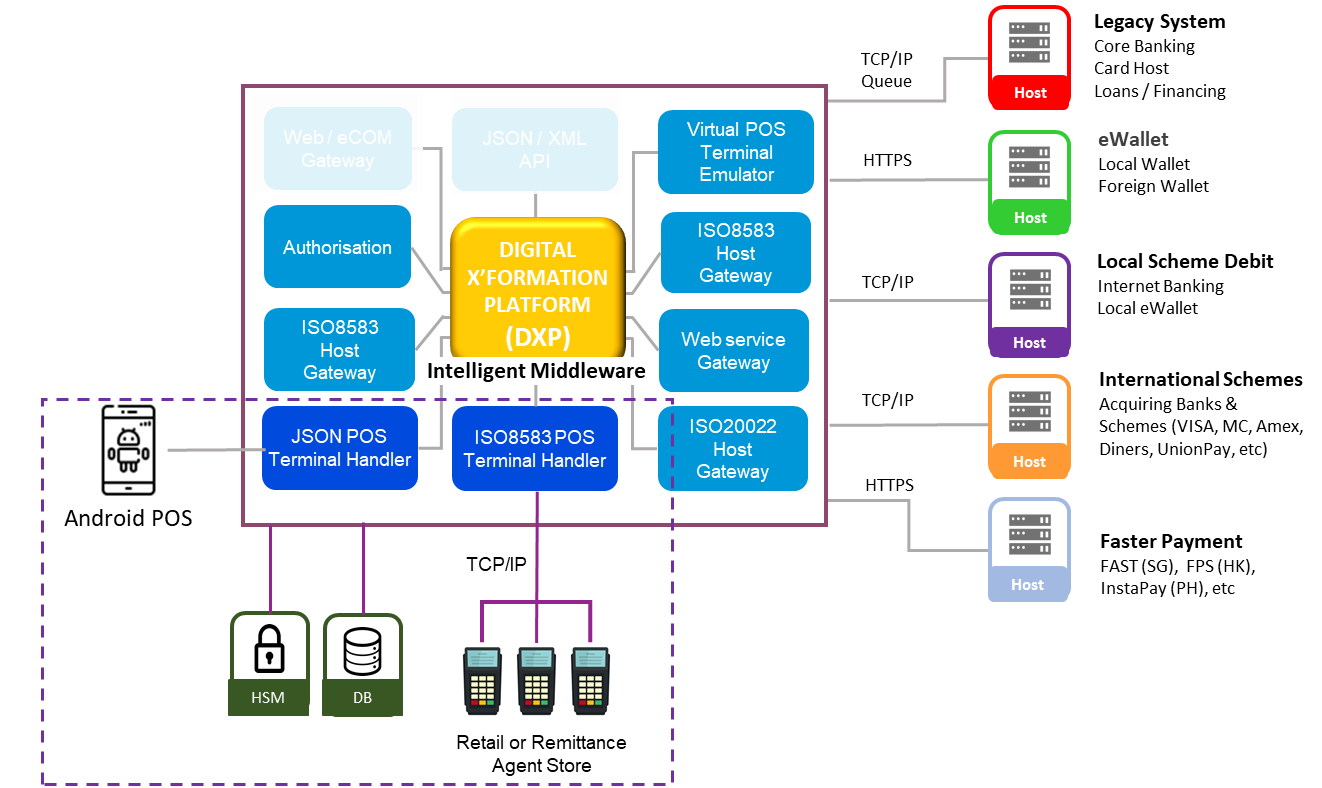

With MVI’s switch coupled with the coming future (DXP) it is very much ideal for Straight-Through Processing and for Interbank to perform cross border real-time payments.

Authorisation/Routing

M^Dynamics Switch offers a common integrated authorisation engine that raises the security against card fraud by providing blacklist check on card, account and user; usage check by card or user; balance check by account; and PIN or password authentication.

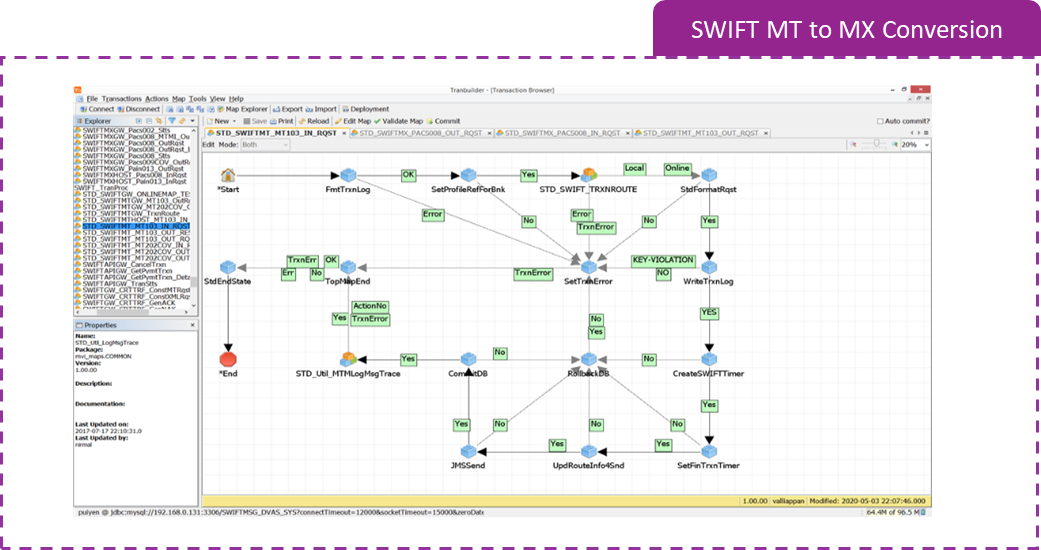

With the Transaction/Process Flow Builder, it can be easily enriched or extended to cater to any specific or unique processing as required by enterprises. With the Flow Analyst, enterprises will be able to quickly understand their existing processing flow in detail to facilitate changes to the system.

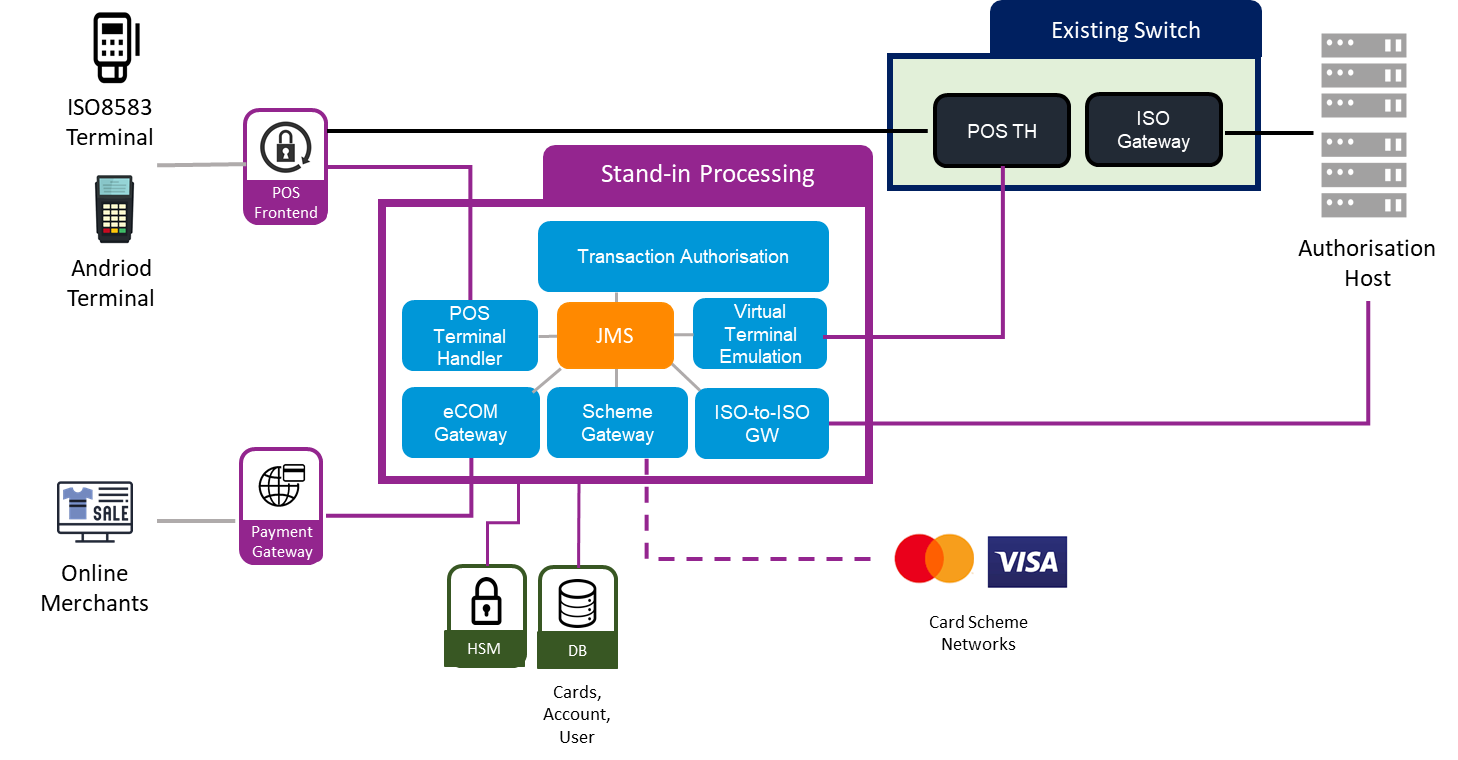

Stand in Authorisation

Empowering Financial Transactions with Stand-in Authorisation on a Mission-Critical System

(Efficient, Reliable, and Secure)

M^Dynamics Stand-in Authorisation: Redefining Financial Transactions

In today’s fast-paced digital economy, uninterrupted financial transactions are not just a convenience—they are a necessity. MVI’s Stand-In Authorisation ensures service continuity, safeguards critical systems, and prevents disruptions that could harm businesses and reputations.

Why Stand-In Authorisation?

Stand-In Authorisation is essential for mission-critical systems that:- Handle high transaction volumes and generate significant revenue.

- Directly impact consumers and retailers/merchants, where downtime results in loss of trust.

- Risk drawing regulatory scrutiny in the event of an abrupt system failure.

Key Differentiator in MVI’s Stand-In Authorisation for Core Banking

Unlike many Stand-In Authorisation solutions in the industry, which lack access to account balances and rely on simplistic limit-based controls, often authorising transactions blindly on behalf of Core Banking systems, MVI’s Stand-In Authorisation solution provides a robust and secure alternative. By leveraging critical data—such as account balances, customer information, and transaction history—MVI’s solution authorises transactions based on available funds, significantly reducing financial risk, enhancing operational reliability, and ensuring compliance with banking standards.

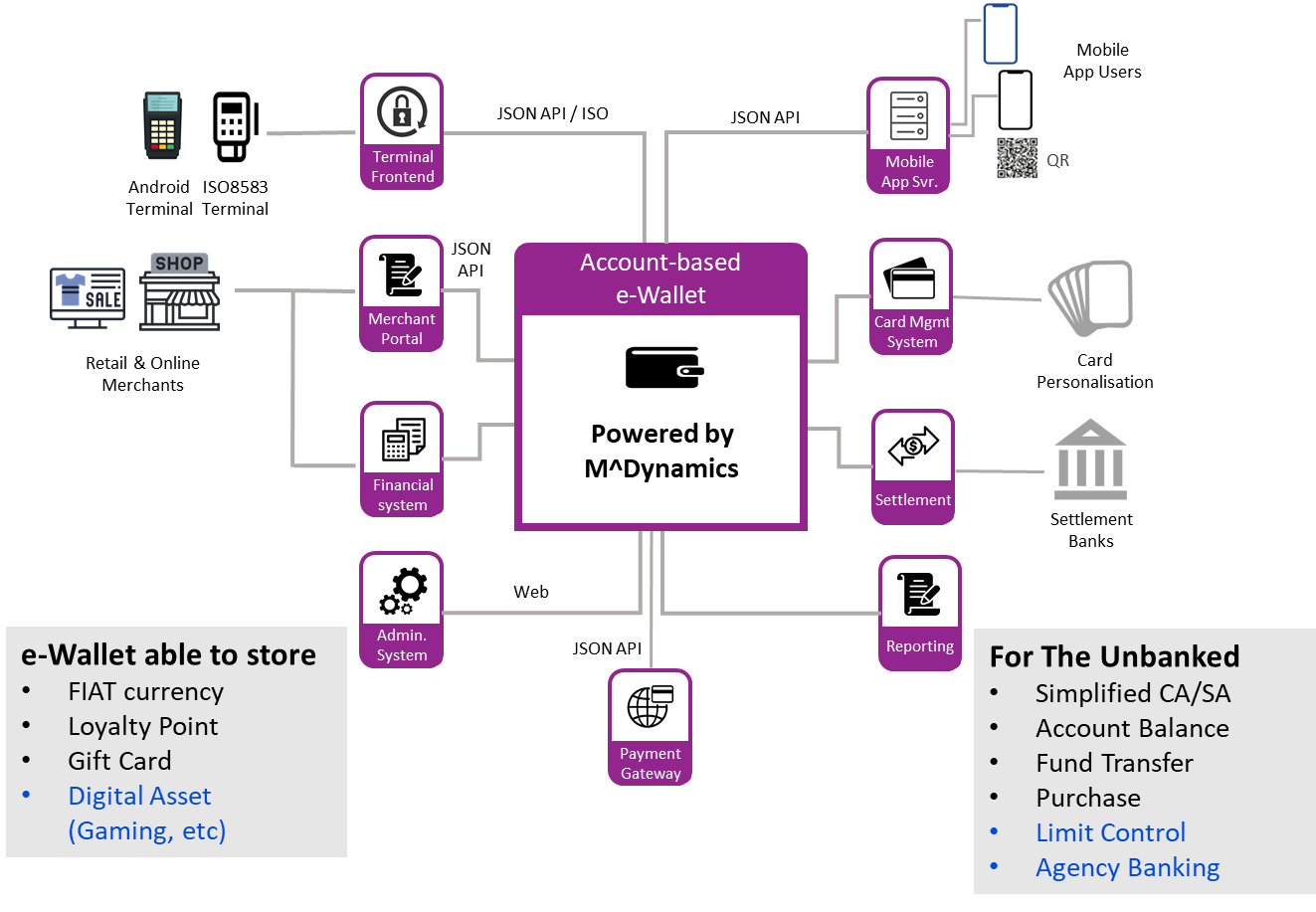

E Wallet Authorisation

• Simplified CA/SA account for the ‘Unbanked’

• Uses Agency Banking to facilitate transactions

• Limited control as needed (ie. Parental control)

All above points to prevent exposure from main accounts, providing better security to your assets.

Equipped with restful APIs that are made available to the Mobile Banking Vendor or any other parties who want to access to the eWallet.

Integrated Solutions

MVI highlight is the use of any of our products to configure a

solution you are looking for.

Any and all products MVI provides can be integrated and combined

to a payment switch/hub according to your requirements and needs.

Our switch solutions incorporate store and forward processing as well.

It will be seamless, well architected, and high quality.

Highly-adaptable, Mission Critical, and Easily Expandable

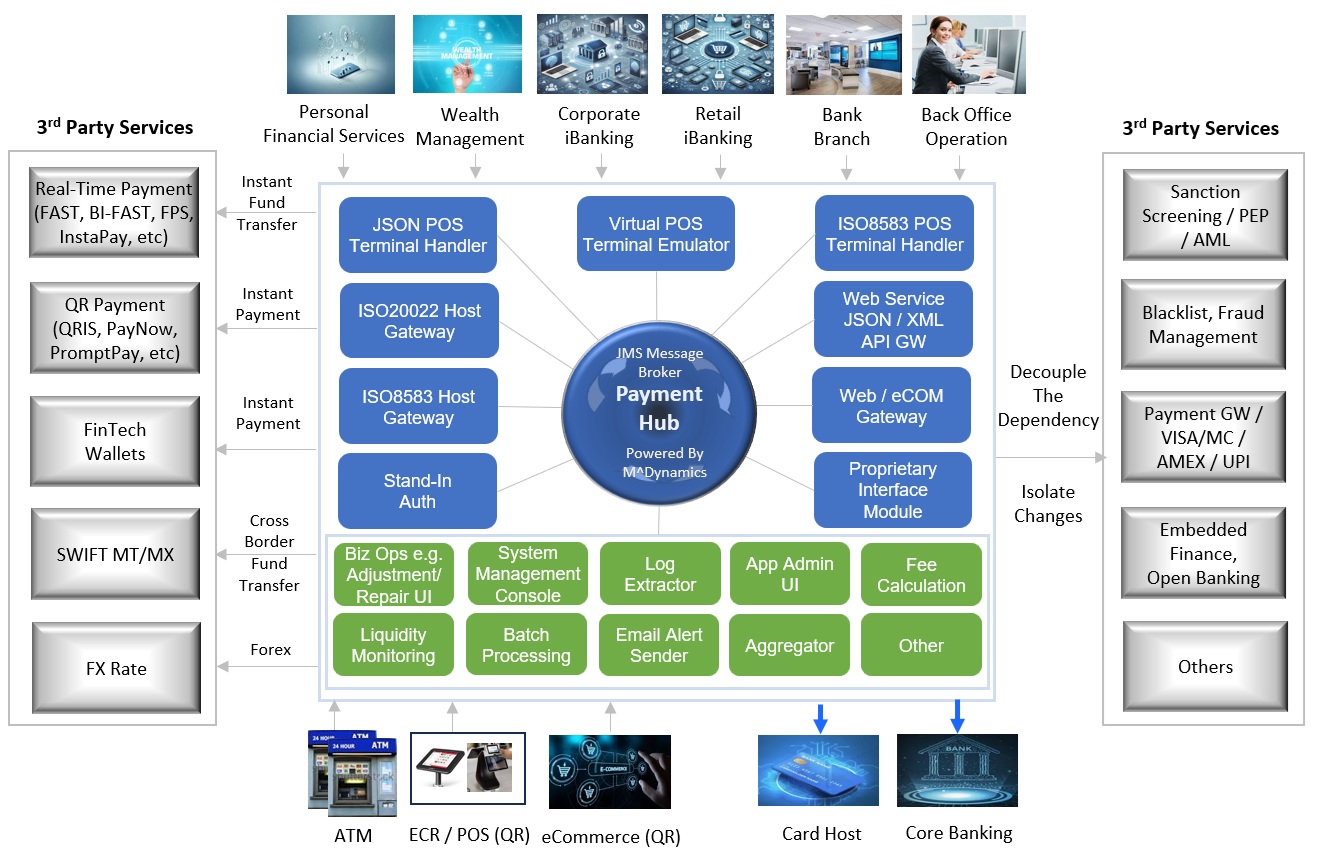

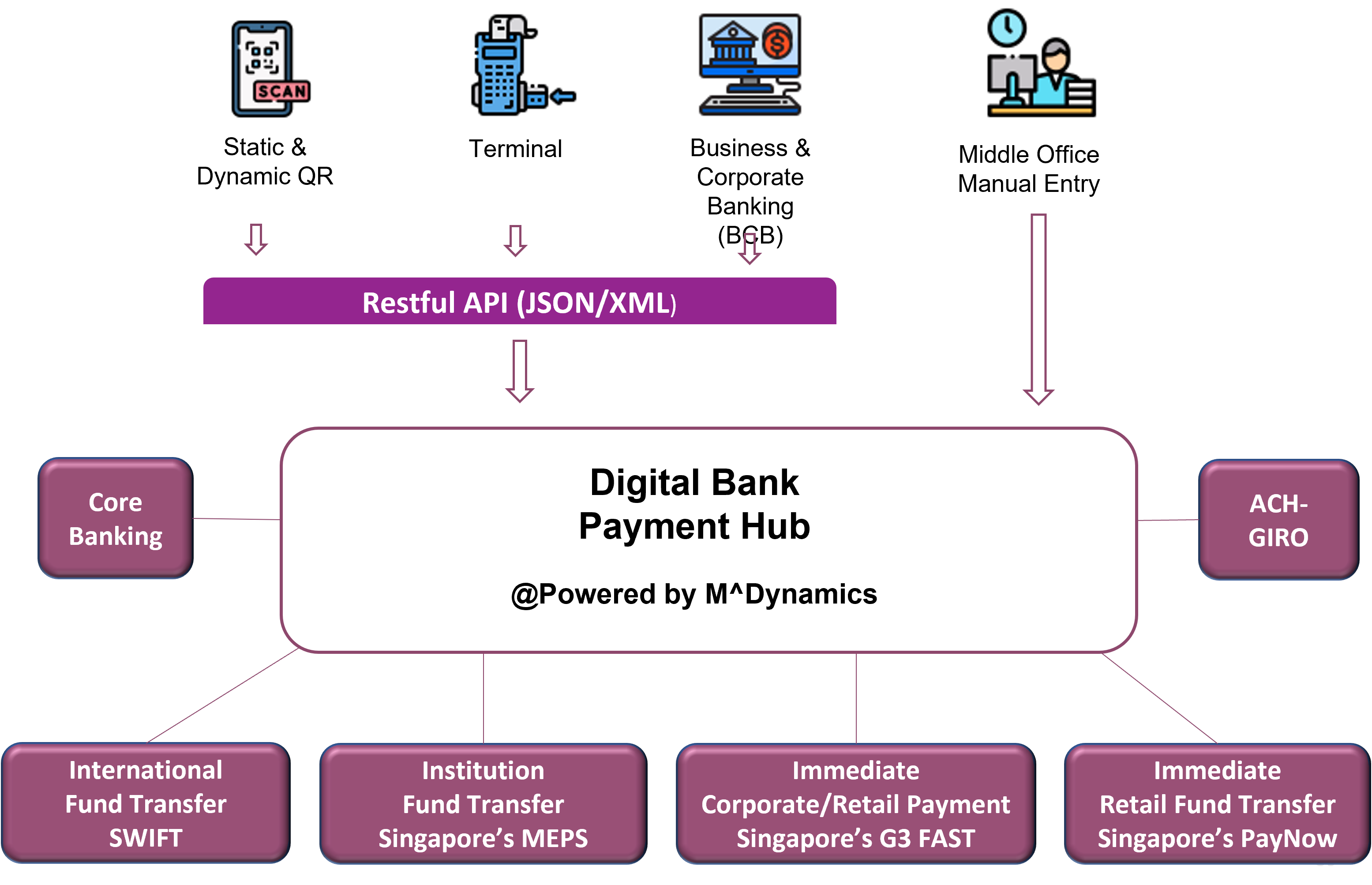

Payment Hub

MVI’s Transformation Hub, featured in the Gartner 2025 Payment Hub paper, effectively addresses complex system challenges with its specialized Payment Hub and Payment Switch, empowering banks to accelerate their digital transformation. This solution enables rapid and seamless integration with any bank’s new or legacy internal systems and external payment services (see diagram), positioning MVI as a leader in the field. To alleviate vendor lock-in concerns, we provide options for clients with source code access for tailored enhancements as needed.